Exporting Goods to Cuba: Legal, Regulatory, and Compliance Considerations

Trade with Cuba remains one of the most intricate—and risky—frontiers in U.S. export regulation. Despite some carefully crafted exceptions for humanitarian aid, agriculture, and certain people-to-people activities, the broader U.S. embargo has now stood for more than sixty years, shaping nearly every aspect of commerce with the island.

Any business exploring Cuban opportunities must tread carefully through overlapping layers of oversight by both the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC) and the U.S. Commerce Department’s Bureau of Industry and Security (BIS). Each agency enforces separate, but interlocking, restrictions that can quickly turn a small oversight into a major compliance failure.

The consequences are serious. Even minor missteps—such as routing payments through a U.S. bank or indirectly touching a sanctioned entity—can lead to substantial penalties and lasting reputational harm. In one notable example, an international financial institution paid $141,000 in 2022 for processing Cuba-related transactions through U.S. correspondent banks. The case underscored a hard truth: when it comes to Cuba, even indirect exposure can carry real enforcement risk.

Statutory and Regulatory Framework

Four principal U.S. statutes collectively define the Cuban trade restrictions and enforcement mechanisms:

|

Statute |

Summary |

Practical Effect |

|

Trading with the Enemy Act (1917) |

Empowers the President to restrict trade during wartime or national emergencies. |

Serves as the legal foundation for the Cuban embargo since 1963. |

|

Foreign Assistance Act (1961) |

Prohibits U.S. aid and authorizes the embargo. |

Bans U.S. economic assistance and technical support to Cuba. |

|

Helms-Burton Act (1996) |

Codifies the embargo and authorizes lawsuits against foreign companies ‘trafficking’ in confiscated U.S. property. |

Exposes non-U.S. companies, such as hotel chains or shipping firms, to U.S. litigation. |

|

Trade Sanctions Reform and Export Enhancement Act (2000) |

Allows limited agricultural, medical, and humanitarian exports. |

Permits controlled trade subject to OFAC/BIS licensing and payment restrictions. |

Compliance Flowchart and Examples

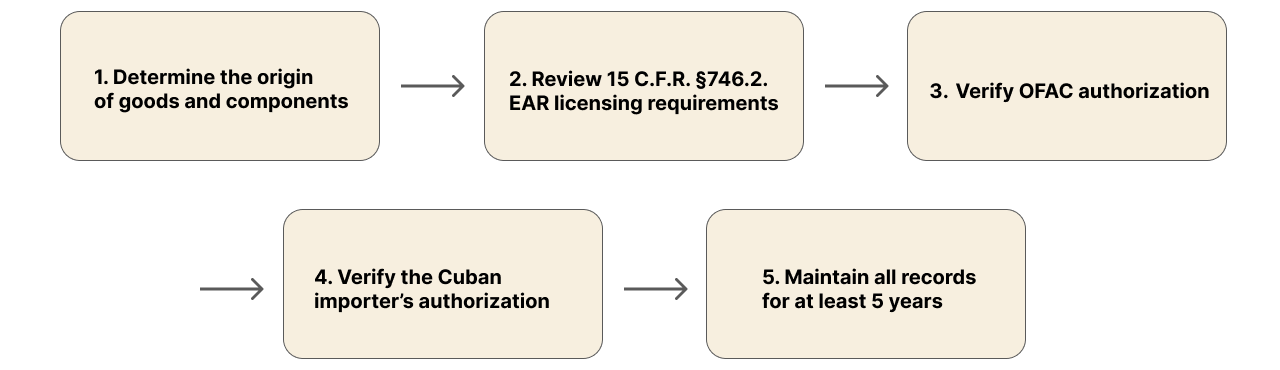

Compliance with U.S. regulations on Cuba must be exact—there’s no room for shortcuts. Below is the typical process, with real-world examples to illustrate each step:

- Determine if the goods are U.S.-origin or contain U.S. components.

Example: A Canadian distributor exporting U.S.-made telecommunications equipment must still secure a BIS license, even though it’s based outside the United States. - Review EAR licensing requirements under 15 C.F.R. §746.2.

Example: Agricultural exports may qualify under License Exception AGR, while most consumer goods require case-by-case approval from the U.S. Commerce Department. - Verify OFAC authorization.

Example: In 2021, a U.S. travel agency paid $150,000 in penalties for arranging unauthorized educational trips to Cuba under an incorrectly applied general license. - Confirm that the Cuban importer holds proper authorization from its own government.

- Maintain all records for at least five years as required by 31 C.F.R. §501.601 and 15 C.F.R. §762.6—a crucial step in demonstrating good-faith compliance during audits or investigations.

Illustrative Enforcement Actions

Several OFAC and BIS cases illustrate the significant exposure businesses face:

- In 2019, American Express Travel Related Services paid $343,315 for processing transactions for Cuban nationals located outside Cuba through foreign subsidiaries, demonstrating the broad reach of OFAC jurisdiction.

- In 2020, Biomin America, Inc., an animal nutrition company, agreed to pay $257,862 for unauthorized exports of agricultural products to Cuba through third countries. Although agricultural goods are generally licensable, the company failed to obtain the required specific license from OFAC.

- In 2022, Exxon Mobil Corp. filed suit under Title III of the Helms-Burton Act against foreign oil companies for alleged ‘trafficking’ in expropriated assets. While the litigation remains pending, it underscores potential exposure for foreign entities operating in Cuba.

- In 2023, OFAC announced a $1.5 million settlement with a European shipping firm for transporting cargo on behalf of Cuban entities. Even though the firm was non-U.S., its payments cleared through the U.S. financial system, triggering OFAC jurisdiction.

Risk Matrix and Mitigation

|

Risk |

Description |

Mitigation Strategy |

|

Sanctions Liability |

Violations of CACR or EAR can lead to civil penalties up to $330,947 per violation and criminal fines up to $1 million. |

Conduct pre-transaction screening through OFAC’s Sanctions List Search tool and engage counsel for license reviews. |

|

Indirect Exposure |

Transactions routed through foreign banks may still involve U.S. correspondent accounts. |

Include sanctions-representations clauses and audit payment flows. |

|

Policy Shifts |

Regulatory policy toward Cuba can change abruptly depending on the U.S. political climate. |

Include regulatory-change clauses and maintain legal monitoring subscriptions. |

|

Reputational Risk |

Trade with sanctioned jurisdictions may impact public and investor perception. |

Maintain ESG and transparency documentation emphasizing lawful, humanitarian purposes. |

Hypothetical Compliance Scenario

Imagine a U.S. manufacturer of medical diagnostic devices planning to sell equipment to a hospital in Havana. Under the Trade Sanctions Reform and Export Enhancement Act, this transaction may qualify for the medical exception—but strict conditions apply. The exporter must first secure a specific OFAC license, confirm that no prohibited end-users are involved, and ensure all payments are processed through a non-sanctioned financial institution in a third country.

If even one of these requirements is overlooked, the company could be found in violation of both OFAC and BIS regulations—exposing it to serious penalties, enforcement actions, and reputational harm.

Conclusion

Exporting to Cuba demands meticulous compliance and legal precision. Every transaction—no matter how small—falls under a web of overlapping export control and sanctions laws. Recent enforcement actions show that even indirect or technical missteps can lead to steep penalties and lasting reputational damage.

Professional law firms guide clients through the complexities of OFAC and BIS licensing, conduct compliance audits, and design strategic transaction structures to ensure every step aligns with U.S. sanctions law—protecting both your business and your global operations.

English

English  Español

Español  Русский

Русский  Turkish

Turkish  Persian (فارسی)

Persian (فارسی)  Arabic (العربية)

Arabic (العربية)  简体中文 (中国)

简体中文 (中国)