OFAC Whistleblowing: Exposing Sanctions Violations Under U.S. Law

The Office of Foreign Assets Control (OFAC) stands among the most influential arms of the U.S. Department of the Treasury, charged with administering and enforcing economic and trade sanctions that safeguard national security, foreign policy, and financial integrity.

As global sanctions regimes expand—targeting nations like Russia, Iran, North Korea, and Venezuela, as well as emerging sectors such as cryptocurrency—the risk of corporate exposure to OFAC enforcement has reached unprecedented levels.

Within this high-stakes environment, OFAC whistleblowers play a crucial role. These are the employees and professionals who step forward to expose sanctions violations, often uncovering complex schemes involving shell companies, falsified records, or cross-border payment manipulation—all designed to evade U.S. sanctions and conceal illicit activity.

I. Statutory Framework and Enforcement Authority

OFAC’s authority is rooted in several cornerstone federal statutes that empower the U.S. government to restrict or prohibit financial dealings tied to national security threats and illicit conduct:

- The International Emergency Economic Powers Act (IEEPA) – grants the President broad authority to regulate commerce in response to unusual or extraordinary foreign threats.

- The Trading with the Enemy Act (TWEA) – governs sanctions during wartime or national emergencies.

- The Foreign Narcotics Kingpin Designation Act (Kingpin Act) – targets major foreign drug traffickers and their financial networks.

Together, these laws form the backbone of OFAC’s enforcement power. Its regulations—codified in Title 31, Parts 500–599 of the Code of Federal Regulations—cover sanctions programs spanning Cuba, Iran, Russia, Belarus, and dozens of other jurisdictions.

Enforcement efforts are reinforced by close collaboration with the Department of Justice (DOJ), which handles criminal prosecutions, and the Financial Crimes Enforcement Network (FinCEN), which supports OFAC through financial intelligence and data analysis.

II. Legal Channels for OFAC-Related Whistleblowing

Although OFAC does not operate its own whistleblower office, individuals who report sanctions violations may still qualify for legal protection and financial rewards under several existing federal programs. These frameworks—administered by agencies such as the U.S. Department of the Treasury, the Securities and Exchange Commission (SEC), and the Commodity Futures Trading Commission (CFTC)—extend key safeguards to those who expose misconduct tied to sanctions evasion, money laundering, or related financial crimes.

|

Program |

Administering Agency |

Coverage of OFAC Violations |

Reward / Protection |

|

SEC Whistleblower Program (Dodd-Frank Act) |

U.S. Securities and Exchange Commission |

When violations involve public companies or investor misrepresentations related to sanctions |

10–30 % of monetary sanctions; anti-retaliation rights |

|

AML Whistleblower Program (31 U.S.C. § 5323) |

FinCEN / Treasury |

When sanctions evasion involves money-laundering or Bank Secrecy Act violations |

10–30 % reward; anonymity through counsel |

|

False Claims Act (31 U.S.C. §§ 3729–3733) |

Department of Justice |

When violations defraud the U.S. government or export programs |

Up to 30 % of recovered funds; civil qui tam rights |

|

Sarbanes–Oxley Act |

Department of Labor / OSHA |

Protects whistleblowers at public companies disclosing fraud or illegal acts |

Anti-retaliation remedies |

III. Common Types of OFAC Violations Reported

- Use of third-country intermediaries to mask transactions with sanctioned entities.

- Misrepresentation in OFAC license applications or end-user documentation.

- Banks processing or failing to block prohibited transfers.

- Cryptocurrency or fintech platforms facilitating wallet transactions linked to sanctioned jurisdictions.

- Corporate acquisitions or supply chains involving SDNs (Specially Designated Nationals).

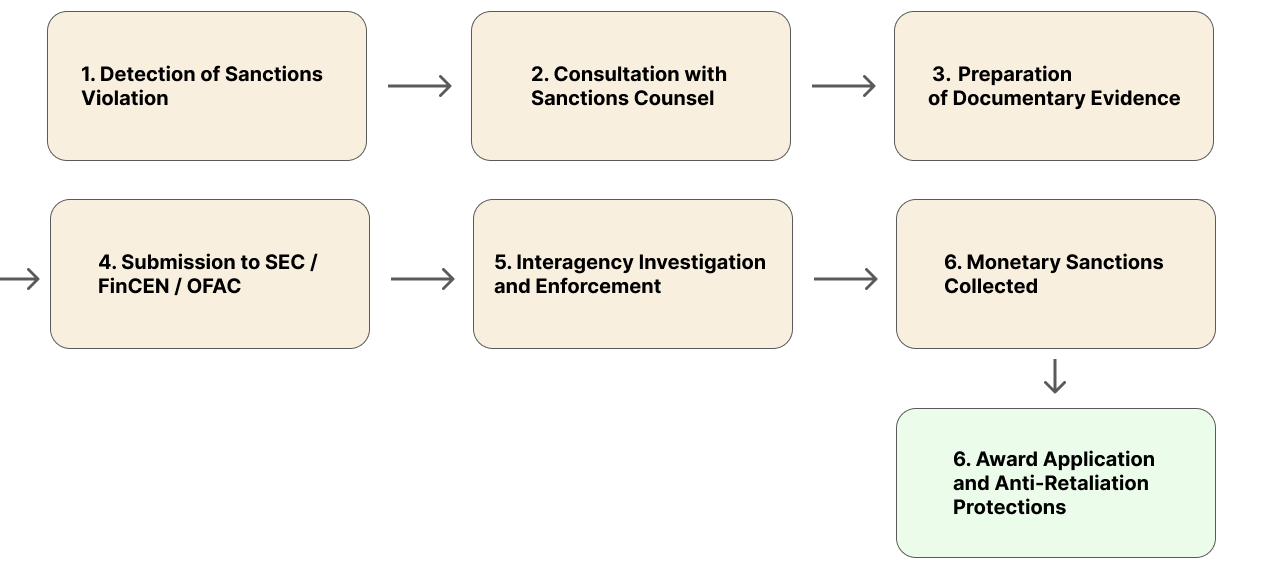

IV. The Whistleblowing Process

- Confidential consultation with counsel experienced in sanctions law.

- Preparation of documentary evidence (emails, data, reports).

- Submission of a formal tip to SEC, FinCEN, or OFAC via counsel.

- Government investigation involving OFAC, FinCEN, DOJ, and SEC.

- Award determination: eligible whistleblowers may receive 10–30% of sanctions collected.

Flowchart: OFAC Whistleblowing Pathway

Inter-Agency Coordination

V. Case Examples

- Payoneer Inc. (2021): $1.4 million settlement; internal staff reported OFAC violations.

- Amazon.com (2020): $134,000 penalty for exports to sanctioned regions.

- Binance (2023): Over $4 billion in penalties; whistleblower cooperation critical.

VI. Conclusion

OFAC whistleblowers safeguard the U.S. financial system from illicit practices. With legal representation, they can disclose violations lawfully, obtain monetary rewards, and remain protected under federal law.

English

English  Español

Español  Русский

Русский  Turkish

Turkish  Persian (فارسی)

Persian (فارسی)  Arabic (العربية)

Arabic (العربية)  简体中文 (中国)

简体中文 (中国)